Fintech App Development: Trends, Challenges, and the Role of Data Analytics

The financial services industry has undergone a massive transformation in the past decade. From digital wallets and investment apps to AI-powered robo-advisors, the adoption of fintech solutions has fundamentally changed the way consumers interact with money. Businesses, too, are leveraging fintech to streamline operations, improve customer experiences, and drive new revenue streams.

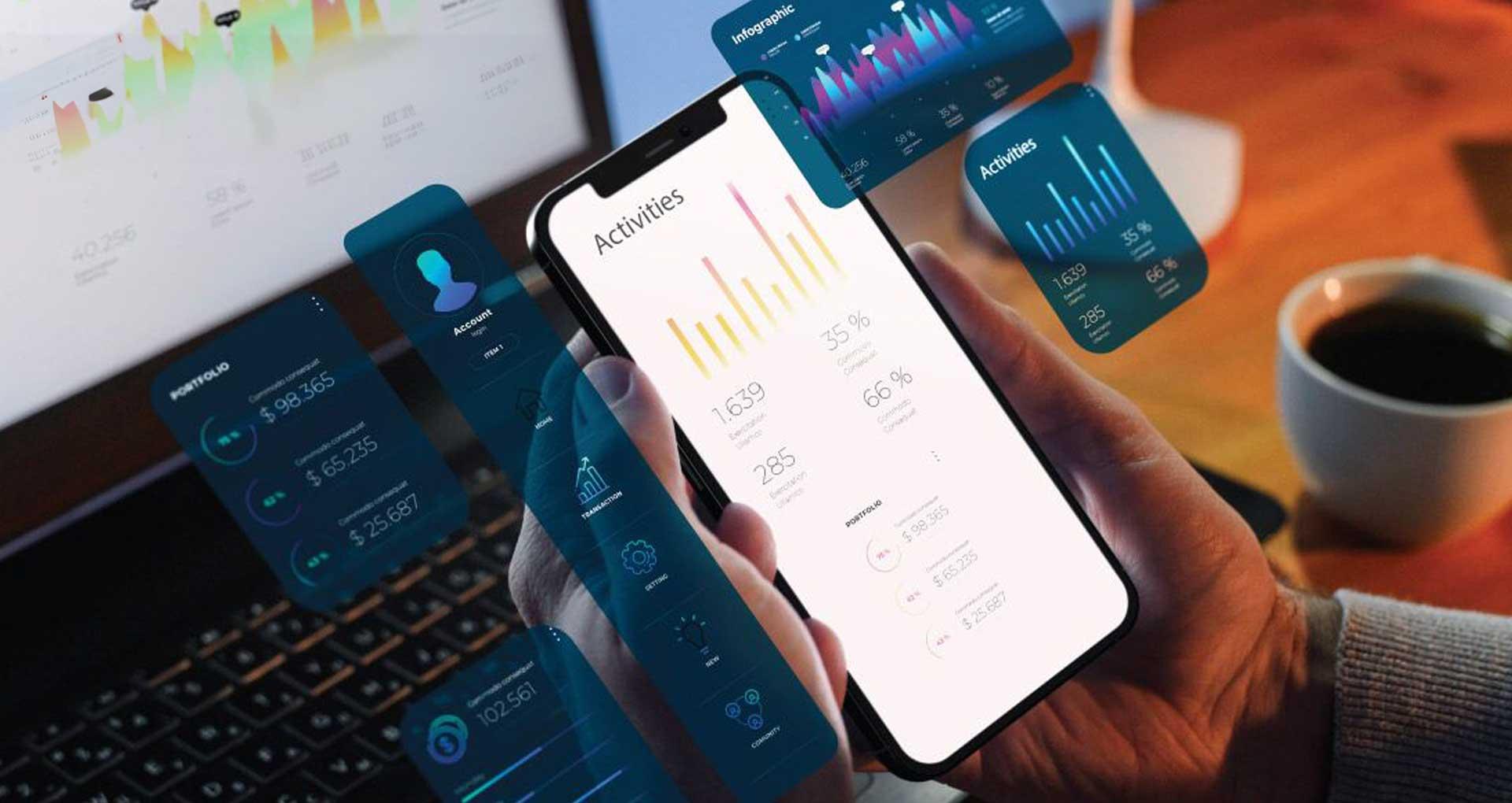

At the core of this transformation lies fintech app development, a discipline that combines cutting-edge technology with financial expertise to create seamless, secure, and scalable solutions. With billions of dollars invested annually in fintech startups, the demand for innovative applications is at an all-time high.

This article explores the landscape of fintech app development, key trends, challenges, and most importantly, the role of data analytics in fintech in building smarter, future-ready applications.

Why Fintech App Development Matters Today

The global fintech market is expected to surpass $900 billion by 2030, growing at a CAGR of over 20%. This growth is fueled by rising smartphone penetration, demand for contactless payments, and evolving consumer expectations for personalized financial services.

For businesses, investing in fintech app development services is no longer optional—it’s a strategic imperative. These services enable banks, startups, and enterprises to:

-

Reach broader audiences with mobile-first financial solutions.

-

Enhance customer experiences through intuitive design and AI-driven personalization.

-

Stay compliant with evolving regulations like GDPR, PSD2, and PCI-DSS.

-

Drive innovation with blockchain, cloud, and machine learning integrations.

In short, fintech apps have become the bridge between traditional finance and the digital-first world.

Emerging Trends in Fintech App Development

To build a successful fintech app, businesses must align with the latest technological and consumer trends. Here are some that stand out:

1. AI and Machine Learning for Personalization

Consumers expect apps to understand their needs and provide tailored recommendations. AI and ML make this possible by analyzing spending patterns, credit history, and investment behavior. From fraud detection to robo-advisory, machine learning is redefining fintech.

2. Blockchain-Powered Transactions

Decentralized finance (DeFi) and blockchain are transforming trust in financial systems. Blockchain ensures transparency, lowers transaction costs, and speeds up cross-border payments—making it indispensable in modern fintech solutions.

3. Contactless and Biometric Payments

Post-pandemic, digital wallets, NFC payments, and biometric authentication have become mainstream. Secure, convenient payment methods are now essential features in fintech apps.

4. RegTech Integration

Regulatory technology (RegTech) ensures compliance while minimizing operational risks. Automated KYC (Know Your Customer), AML (Anti-Money Laundering), and fraud detection systems are becoming must-haves.

5. Cloud-Based Financial Services

Cloud adoption in fintech brings scalability, cost savings, and faster deployments. It also enables real-time data sharing across stakeholders, enhancing collaboration and customer service.

The Role of Data Analytics in Fintech

No discussion of fintech innovation is complete without highlighting data analytics in fintech. With financial institutions generating terabytes of data daily, advanced analytics is the key to unlocking actionable insights.

Here’s how data analytics is shaping fintech app development:

-

Customer Behavior Analysis: By studying transaction patterns and app usage, developers can create personalized experiences that keep users engaged.

-

Fraud Detection: Real-time analytics detect anomalies, preventing fraudulent activities before they escalate.

-

Credit Scoring: Traditional credit scoring models are often rigid. Data analytics enables dynamic, multi-factor credit assessments, especially for underbanked populations.

-

Risk Management: Predictive analytics helps institutions manage risks by forecasting market movements and customer defaults.

-

Product Innovation: Analytics uncovers gaps in customer needs, inspiring new fintech products and features.

For example, a mobile banking app that uses predictive analytics can proactively alert customers about unusual spending or upcoming bills, improving trust and retention.

Key Features of a Successful Fintech App

When partnering with fintech app development services, businesses must prioritize features that enhance security, usability, and scalability. Essential features include:

-

Advanced Security Protocols

Multi-factor authentication, biometric logins, data encryption, and compliance with PCI-DSS and GDPR ensure safety. -

Seamless User Experience

A clean interface with easy navigation ensures users can quickly complete transactions without friction. -

Personalization Engines

AI-driven insights to offer tailored financial advice, investment tips, and spending reports. -

Multi-Currency and Cross-Border Support

With global trade and freelancing on the rise, fintech apps must support multiple currencies and smooth international transfers. -

Offline Functionality

Many emerging markets still face internet connectivity issues. Apps that allow limited offline operations have an advantage. -

Integration with Ecosystem

APIs to connect with third-party services like payment gateways, insurance providers, or accounting tools increase app utility.

Challenges in Fintech App Development

Building a fintech app is not without its hurdles. Businesses must be prepared to address:

1. Security and Compliance

Cybersecurity remains the top challenge. Developers must implement robust security frameworks while adhering to local and international compliance standards.

2. Competition and Differentiation

The fintech app market is crowded. Without unique value propositions, apps risk getting lost among competitors.

3. Scalability

As user bases grow, apps must handle surging traffic without compromising speed or reliability.

4. Customer Trust

Trust is hard to earn in finance. Transparent operations, reliable customer support, and strong data protection practices are vital.

5. Technology Integration

Integrating blockchain, AI, and other technologies requires specialized expertise—making the choice of the right fintech app development services crucial.

Why Partner with Professional Fintech App Development Services?

Developing a fintech app requires more than coding skills—it demands deep knowledge of finance, compliance, and emerging technologies. Professional fintech app development services bring this expertise to the table.

They provide:

-

Custom Solutions: Apps tailored to specific business models and target audiences.

-

End-to-End Development: From ideation and prototyping to testing and deployment.

-

Compliance Assurance: Inbuilt KYC/AML modules and adherence to financial regulations.

-

Scalable Architecture: Apps designed to handle future growth seamlessly.

-

Post-Launch Support: Continuous monitoring, updates, and security patches.

By leveraging specialized services, businesses can reduce time-to-market, minimize risks, and maximize ROI.

Future of Fintech App Development

Looking ahead, the next wave of fintech will be defined by hyper-personalization, AI-first experiences, and decentralized finance. We can expect:

-

Wider adoption of embedded finance, where non-financial apps integrate payment and lending features.

-

Growth in green fintech, enabling sustainable investment portfolios.

-

Deeper reliance on data analytics in fintech for real-time decision-making.

-

Use of generative AI for customer support and financial planning.

-

Expansion of IoT-driven finance, where connected devices facilitate instant, context-aware payments.

Conclusion

The fintech revolution is here to stay, reshaping how individuals and businesses manage money. With innovations in AI, blockchain, and cloud, the opportunities are immense. But success in this space requires more than just technology—it demands user-centric design, compliance, and actionable insights powered by data analytics in fintech.

By partnering with expert fintech app development services, businesses can navigate the challenges, harness emerging trends, and deliver financial products that are secure, scalable, and future-ready.

In a world where finance meets technology, those who innovate thoughtfully will lead the charge into the digital economy of tomorrow.

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness